The new tax law created by 2017’s Tax Cuts and Job Acts introduced a 20% tax deduction for eligible pass-through business owners called the Qualified Business Income (QBI) deduction. However, there are limitations to the tax break; high-income business owners in service trades (like lawyers, accountants or consultants) will not qualify if their income exceeds a certain threshold. Here are some personal and business income strategies to consider before year end to help keep you under the limit.

The new tax law created by 2017’s Tax Cuts and Job Acts introduced a 20% tax deduction for eligible pass-through business owners called the Qualified Business Income (QBI) deduction. However, there are limitations to the tax break; high-income business owners in service trades (like lawyers, accountants or consultants) will not qualify if their income exceeds a certain threshold. Here are some personal and business income strategies to consider before year end to help keep you under the limit.

For added background, high-income small business owners in a “specified service trade or business” (SSTB) do not qualify for the QBI deduction if their taxable income is above $415,000 married filing jointly, and $207,500 for other filers. For all non-service businesses, the income cap does not apply.

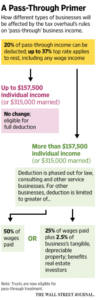

The QBI deduction provides a substantial tax-savings opportunity for pass-through business owners where only 80% of their business income is taxed. The biggest hurdle for using this deduction is qualifying via a series of tests once income exceeds the thresholds. The rules are complex and apply differently depending on how the business is classified. The nearby chart from the Wall Street Journal offers some clarity on how the new rules apply.

All business owners should consider steps to reduce their taxable income where possible. What follows is several options to consider that should apply to most businesses:

- Maximize eligible retirement plan contributions, including, IRAs, SEP IRAs, 401(k)s, and defined benefit pension plans, among others.

- If you have the ability to push revenue receipts into 2019 and if 2019 is likely to be a lower income year than 2018, you should aim to defer recognizing income in the current year (where possible).

- Conversely, any expenses that can be fully depreciated in 2018, such as certain capital investments allowed under the new tax law, may be able to receive accelerated depreciation, which will reduce your current year’s taxable income. Alternatively, consider opting for regular depreciation instead of bonus depreciation to even out taxable income over several years if you expect income to be higher in future years where extended depreciation may be more valuable.

- Consider making charitable gifts, including implementing a donor-advised fund (DAF), especially if you have a large capital gain or liquidity event and want to be charitably inclined while driving down income. DAFs can be used so that taxpayers receive an instant tax deduction when they open and fund the account, yet the funds need not be immediately sent to charities; they can sit in the DAF until a future time when you select charities to fund. Other charitable options remain available as well, such as various charitable trusts.

- Business owners and employees can contribute up to $6,900 for a family, or $3,450 for individuals, into a health savings account (HSA) which is a tax-deductible contribution that can lower taxable income.

An additional step that CCMI takes for investment clients is to complete tax-loss harvesting prior to year-end. By selling stocks that have sufficient tax-losses, taxpayers can deduct up to $3,000 of their excess losses, and anything above the $3,000 is carried over into the next year. Ultimately, harvesting the losses helps reduce ordinary income. This strategy will also help offset any capital gains created during 2018.

There are many strategies available to help reduce your taxable income and you should work with your CPA and/or financial advisor to determine what options may be available. The bottom line is that the QBI deduction can be a powerful savings tool that all business owners should investigate. Even if it isn’t possible to get under certain income thresholds, know that there are always steps you can explore to try to reduce taxable income before the end of the year. Give CCMI a call if you have questions about how to minimize your taxes and qualify for QBI.

This article was adapted from a Horse’s Mouth Publication.

CCMI provides personalized fee-only financial planning and investment management services to business owners, professionals, individuals and families in San Diego and throughout the country. CCMI has a team of CERTIFIED FINANCIAL PLANNERTM professionals who act as fiduciaries, which means our clients’ interests always come first.

How can we help you?